Outsourcing

Outsourcing service providers range in size from small and mid-sized shops that focus on a very specific set of services to mega-vendors like IBM, Capgemini and Infosys that can outsource a Fortune 500’s entire enterprise. We’ll cover the pros and cons of small/mid-sized and larger providers in Part 2. From short term projects to ongoing 24/7 support, clients can choose from a broad range of outsourcing options and services.

We know that outsourcing’s initial key value propositions were cost reduction and the ability to provide clients with a predictable, fixed monthly cost. As the industry matured and became more competitive, outsourcing providers began to expand their value propositions to differentiate themselves from their competitors. Savvy outsourcing customers are now able to totally customize a relationship that meets their unique needs.

Offshore

Offshore providers’ primary value proposition continues to be reducing human labor costs. Although India continues to be the global leader in offshore outsourcing, other nations are mounting an ever-increasing challenge to India’s dominance. Countries in Eastern Europe, the Middle East and other Asian nations are all competing for the outsourcing consumer’s dollar.

The challenges offshore providers face are data security and IP protection concerns, verbal and written communication issues, work quality, social stability questions and time zone differences. As a customer of offshore services, I experienced some of these same issues. As a provider, these problems continue to be the reasons why clients decide to bring their services back onshore.

In addition, you will be evaluating both the vendor and the vendor’s country of origin. Although communication systems infrastructure and social stability questions aren’t big problems for countries like India and China, you’ll need to be cognizant of these potential issues when you are evaluating offshore providers from other nations.

This isn’t intended to be an indictment of offshore. In an upcoming installment of this series, I’ll provide vendor selection best practices. Like all 3rd party service provider evaluations, the quality of the services you receive will depend on the caliber of your vendor analysis.

Nearshore

Unlike their offshore counterparts that target all countries that have high labor costs, nearshore providers focus primarily on US firms. In addition to cost reduction, these South American vendors promote the benefit of being in the same time zone as their US customer base. Along with the traditional offshore concerns, social stability and the quality of their country’s communication systems infrastructure are critical vendor analysis criteria.

Onshore

Onshore providers understand that they’ll be competing against offshore vendors that are able to leverage low cost human labor to offer very cost-effective hourly rates. It is a real challenge for onshore providers to compete against an offshore vendor when cost is the customer’s primary evaluation criteria.

To differentiate their offerings from offshore and nearshore vendors, onshore providers expand their value proposition by promoting the quality of their services, the security of their service delivery architecture, US time zones, ease of communications, improving the customer’s ability to quickly support new technologies and immediate access to advanced skill sets.

Rural Shore

Rural shore is an offshoot of onshore outsourcing. My current employer, RadixBay, is a rural shore services provider. In addition to the traditional onshore value propositions, RadixBay and our rural shore competitors differentiate our offerings by promoting both the quality and the cost effectiveness of our services. We leverage the lower cost of living in rural areas to provide clients with lower rates than traditional onshore competitors. In RadixBay’s case, our rural shore service delivery center is in Tabor, City North Carolina.

Our strategy is to provide our clients with service delivery rates that are more attractive than our onshore competitors and our value/service quality combination allows us to more effectively compete against offshore providers.

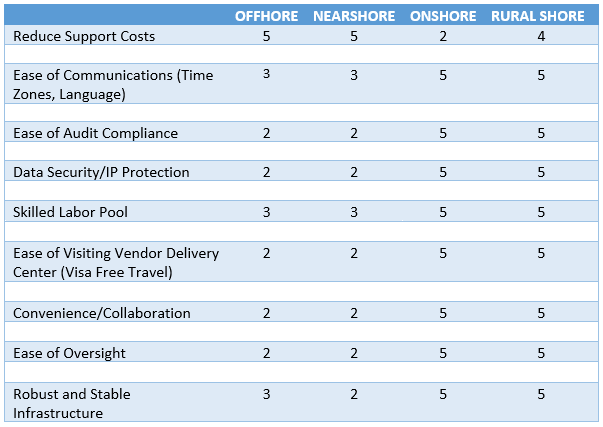

Comparison Chart

The rankings below are from my personal experiences as both a customer of offshore and onshore services. During my tenure as a manager of outsourcing delivery teams, it was a standard practice to ask customers why they were transferring their services from a competitor to our organization. The questions allowed us to evaluate our competitors and quickly address prior service delivery weaknesses.

Rankings from 1 to 5 with 5 being optimal.

Wrap-up

In upcoming installments, we’ll cover what to look for when you evaluate an outsourcing service provider, warning signs to watch out for during your relationship and hints and tips to maximize your outsourcing ROI. In addition, I’ll provide you with several recommendations to prevent you from unintentionally sabotaging the relationship.

Thanks for reading!